How To Find Out Which Collection Agency You Owe

In a Nutshell

If it feels like you're drowning in a sea of debt, it can seem impossible to find a life raft, especially if the debt collectors have already started circumvoluted. Getting a handle on who y'all owe and how much money you owe them is an important outset pace in sorting out your personal finances. This article will give you some tips and tools you tin apply to climb aboard that life raft, catch a paddle, and offset sorting out your fiscal life.

If it feels like you're drowning in a sea of debt, it tin can seem impossible to discover a life raft, particularly if the debt collectors have already started circling. Getting a handle on who yous owe and how much money y'all owe them is an important starting time stride in sorting out your personal finances. Even though this can be intimidating and might experience hopeless, it tin can help you take concrete steps toward moving past your debts.

This article will give you some tips and tools you lot tin use to climb aboard that life raft, grab a paddle, and start sorting out your financial life.

Become Organized

Start by getting yourself organized. If you're similar almost people, you accept a lot of bills to track. This tin exist overwhelming, but you can streamline it by setting up a simple spreadsheet. If you have bills and debt drove letters unopened in your junk drawer, you tin can't get a practiced sense of your fiscal picture show.

To get organized, you need two things: a spreadsheet for the numbers and a file for the papers.

Create a Simple Spreadsheet

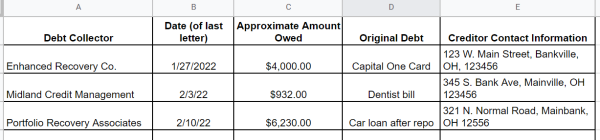

The outset affair is a place to write down each bank, debt collector, and collection agency you owe money to, and how much you owed them on what date. Nigh people will utilize a simple spreadsheet for this. Y'all can put the proper noun of the creditor in column A, the engagement in column B, and the amount you owe in column C.

Information technology'southward also a adept idea to characterization the type of debt, so y'all tin see at a glance which debts might be governed by dissimilar rules for collection purposes. Start by putting the original creditor or information about the debt in column D.

-

Secured debts are debts that have something bankroll them upwardly like your mortgage or automobile loan. These are debts where your property could be repossessed by a creditor if you're unable to make your payments.

-

Unsecured debts aren't backed upwards by property. Mutual unsecured debts include pupil loans, credit card debt, or medical bills.

-

Priority debts include dorsum taxes, child back up payments, or spousal support (alimony). These debts are labeled as priority debts under the Bankruptcy Code. They tin can't be discharged in bankruptcy.

You lot'll also want to create a column for the contact information for each creditor, including their mailing accost and phone number.

Some people create elaborate spreadsheets to record all their debts and plan them to continue track of interest rates, belatedly fees, and how much each debt grows each month. This is useful information to track. Just if putting this information into the spreadsheet feels overwhelming, y'all can add it afterward. When y'all get started, information technology's more than important to have a general idea of your financial flick.

Organize Your Papers

2nd, you need a safe identify to keep your papers and then they don't become lost. This could be an old-fashioned steel filing cabinet or a simple box with some folders. As you collect papers from each collection bureau, you tin can keep them in this box. Create a dissimilar folder for each creditor and continue all the papers you get from them together.

By keeping everything in 1 place, you lot'll have a record and can keep track of your debts in the future. This will also come up in handy if yous demand to challenge debts that you don't call up you owe any coin on.

Asking Your Gratis Credit Reports

Your credit reports are a perfect starting indicate for figuring out how much y'all owe and who yous owe it to. This is especially true for erstwhile debts you haven't thought about in a while. Your credit written report lists your personal data similar your name and Social Security number along with your credit history for whatsoever credit card, loan, or other credit accounts yous accept.

Every year, you can request a gratuitous copy of your credit written report from each of the three credit bureaus: TransUnion, Equifax, and Experian. The easiest way to practise this is to go to AnnualCreditReport.com. You can as well call (877) 322-8228 to asking a copy of your credit report over the telephone.

When yous become a re-create of your credit history, y'all should make a list of all the collection agencies listed on information technology. Most debt collectors will written report what you owe to one or more of the credit bureaus. You tin use these lists to create your ain listing of debts.

Credit Report vs. Credit Score

Your credit written report is unlike from your credit score. Your credit report lists your credit history, including your credit cards, medical bills, mortgages, car payments, and student loans. This is like a schoolhouse transcript that lists all the classes you've taken. Your credit score is a number that represents how likely you are to pay a debt on time. This is like your GPA, which shows your overall grade.

In that location are credit reporting agencies, similar TransUnion, Equifax, and Experian, that keep information on your credit history and upshot credit reports. And there are likewise credit-scoring companies like FICO and VantageScore. Your FICO and VantageScore use data from the credit reporting agencies to calculate your credit score.

Check Your Credit Reports for Signs of Identity Theft

As you're going through your credit history, information technology'southward a good thought to look for unusual activity that could mean someone stole your identity. For example, you might see a credit card company you don't recognize from a store you never shop at.

If you believe at that place'south an error, send a written letter to each credit agency where the fault is listed. Yous should be very specific about what the fault is, why y'all believe there is a mistake, and ask that the item be removed. The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) have templates you can work from if you need to file a dispute with one of the credit reporting agencies.

Do Your Own Research

After y'all've looked at your credit history, go through your own documents. Wait for your near recent monthly statement for each business relationship you take. It may exist a hard re-create you received in the mail, or you lot may be able to access it digitally online. Not every debt appears on every credit report, so don't skip this pace. Newer debts may not show up however, while debts older than seven years may have already fallen off your credit history.

Check each statement you detect confronting your credit written report to make sure you lot have papers from each collection agency. And then, compare the debt amounts listed on your credit reports to what you retrieve y'all owe. Are whatsoever major discrepancies? If something doesn't look right, you can ask the debt collector for more than data and fifty-fifty challenge whether you lot owe the collection agency whatever money.

Don't exist too alarmed if you see a drove company listed on your credit report that's not your original creditor. It's very common for lenders to sell debts to different collection companies afterwards a certain signal. That said, you can still asking verification to make sure the debt is valid.

You should also check your voicemail and await for any messages left past debt collectors. They should identify themselves past leaving their visitor proper noun and phone number if they are a legitimate company. You lot don't demand to call the company back since they might be aggressive over the phone. But you tin can send a letter requesting that the company verify your debt.

Verify Your Debts

For each debt account you notice, y'all can ship a verification letter to confirm the amount you lot owe. Under the Off-white Debt Drove Practices Deed (FDCPA), all creditors and debt collection agencies must confirm that you do owe them coin and how much you owe.

After you send a written notice requesting the creditor to verify your debt, they can't conduct farther debt collection activities until they respond.

Check the Statute of Limitations for Your State

Debt collectors can only legally sue yous for an old debt for and then long. At some point, the statute of limitations will expire. If a debt collector hasn't filed a lawsuit by that point, their case will get thrown out of courtroom.

Each state has a unlike statute of limitations, and then yous'll need to check your states' laws. Depending on the time period, debts you can still be sued for may or may non appear on your credit history.

If a debt is by the statute of limitations, you won't need to pay it. But, be careful — if you brand a fractional payment, or fifty-fifty hope to pay an old debt, the limitations period tin can reset, meaning that y'all could hazard a debt collection lawsuit.

Keep an Eye Out for Scammers

Finally, equally you're going through your debts, pay attention to anything that doesn't look right. Oft, people discover collection business relationship scams when they go through their credit histories and verify debts.

If someone has stolen your identity and taken out more debt in your name, this can negatively touch your credit score. Bad credit tin can impact a lot of different areas in your life, including how much y'all pay for car or renter'south insurance, the interest rate on a new vehicle, and whether or not y'all go canonical for a habitation loan.

The CFPB has some tips for recognizing scammers.

If a debt collector contacts you, they can't threaten to release data virtually your debt to everyone else, including your boss or family members. They can't withhold sure information about the drove business relationship, like how much you owe, and they can't lie to you.

Let'south Summarize…

Don't permit your debts intimidate you. After all, cognition is power. Before you can take control of your finances, you need to sympathise your debts. By getting organized, checking your credit history, researching your debts, and getting rid of scammers, you'll be putting yourself in a not bad position to make a move toward a healthier fiscal future.

Source: https://upsolve.org/learn/what-debt-collectors-you-owe/

Posted by: griffiththerret99.blogspot.com

0 Response to "How To Find Out Which Collection Agency You Owe"

Post a Comment